For decades, the venture capital (VC) and private equity (PE) markets have been dominated by high-net-worth individuals, institutional investors, and a small circle of financial elites. But now, tokenized equity is changing the game. This emerging technology has the potential to radically democratize access to private investments and transform how capital is raised, distributed, and managed.

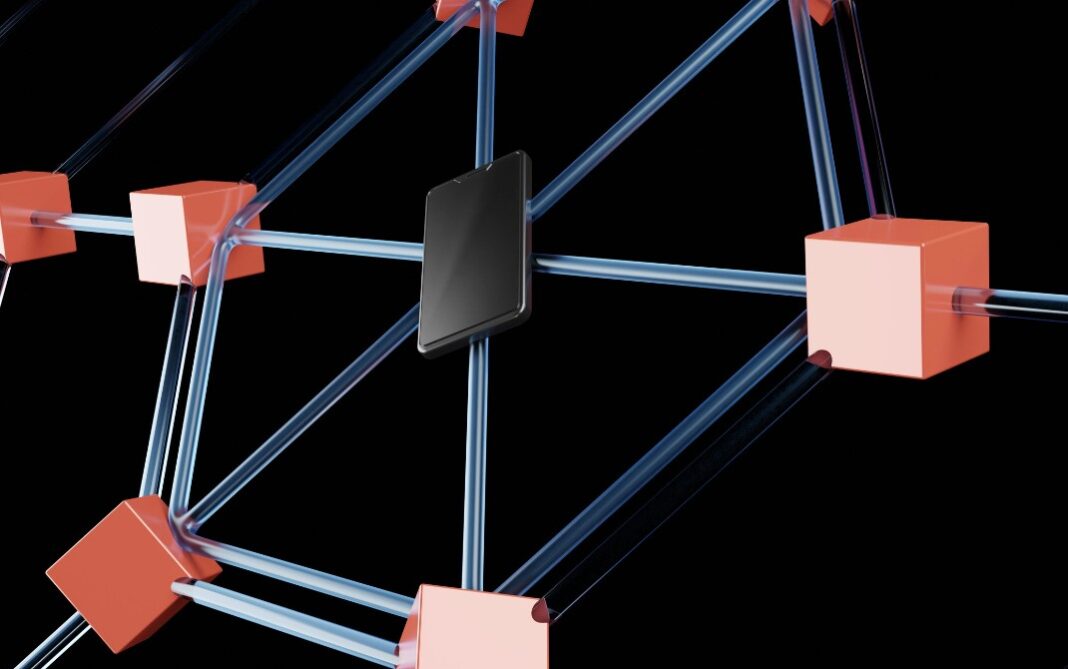

Tokenized equity refers to the use of blockchain technology to represent ownership of equity in the form of digital tokens. These tokens can represent shares in startups, private companies, or other assets. Unlike traditional equity, tokenized shares are fractionalized, allowing investors to purchase smaller portions of an asset and thereby lowering the barrier to entry for smaller investors.

Opening the Market to a New Breed of Investors

Tokenization allows private companies to offer shares directly to a broader pool of investors, expanding opportunities beyond the elite circles of venture capitalists and institutional investors. With traditional VC, the process of raising funds often requires extensive networks and legal complexity, not to mention significant capital requirements for even minor investments. Tokenized equity could level the playing field by allowing retail investors, accredited or otherwise, to participate in private equity markets with fractionalized ownership.

Increased Liquidity and Transparency

Another revolutionary benefit of tokenized equity is liquidity. Unlike traditional private equity investments, which are illiquid and often require long holding periods, tokenized equity can be traded on secondary markets. This unlocks liquidity that has been previously inaccessible to most private investors. Tokenized shares can be bought, sold, or exchanged on blockchain-enabled exchanges, providing flexibility and greater market efficiency.

Additionally, blockchain’s transparent nature means that every transaction is recorded on an immutable ledger, giving investors a clearer view of ownership and reducing the risk of fraud. Transparency in tokenized equity could significantly increase investor confidence, particularly in emerging markets where trust in financial systems can sometimes be lacking.

Lowering the Cost of Capital and Improving Efficiency

Tokenized equity can streamline the fundraising process, significantly reducing overhead costs typically associated with venture capital and private equity. By cutting out intermediaries, such as brokers and investment banks, companies can lower their capital-raising expenses and improve overall efficiency. As a result, startups and growth-stage companies could raise funds more quickly and at lower costs, driving more innovation and growth.

Conclusion

As the blockchain ecosystem continues to mature, tokenized equity is poised to reshape the landscape of VC and private equity. By democratizing access, increasing liquidity, and enhancing transparency, tokenized equity is set to challenge traditional investment models, opening the door to a new era of investing that could be more inclusive, efficient, and accessible.